I’m using the Linux distribution Fedora 16 on my primary home computer at the moment. I don’t particularly like the GNOME 3 interface, so I’ll probably change to Linux Mint with Cinnamon shortly, but I’m stuck with this rather stupidly designed mess in the mean time. In fact I was about to change today before I found a fix for a very weird problem, blue skinned people on YouTube videos!

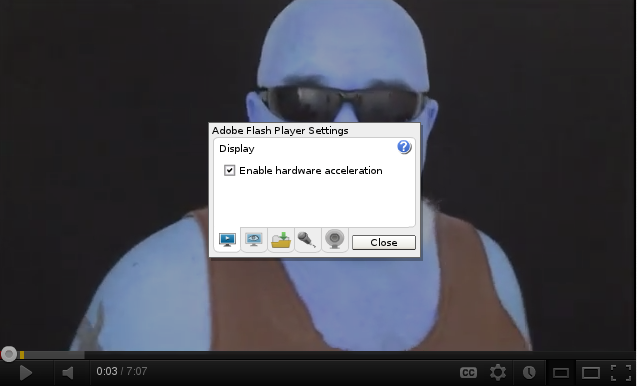

That’s right, you heard it correctly, the people on YouTube videos were blue, just like this one of The Fat Aussie Barstard here.

At first I thought it was some kind of joke from The Fat Aussie Barstard, as he is a bit of a character on YouTube. However, I played another video on YouTube and sure enough that also had a person with blue skin!

When I was using my Macbook Air yesterday I received an update for the Adobe Flash Player, so I had also updated my Linux Fedora 16 PC to the latest version (Adobe Flash Player 11.2). This seemed to be the cause of the problem, as other videos played through VLC or Media Player were fine.

After a bit of googling I found a solution that has worked for me. You need to turn off the “Enable hardware acceleration” option on the Adobe Flash Player Settings window.

To do this, right-click anywhere on the video and select “Settings” at the bottom of the menu. You should then see the following window appear on top of the video where you need to de-select the check box option.

Once you have done that just reload the page to get the video playing with normal skin tones!

I’m not sure who is to blame for this latest example of why Linux distributions are NOT ready for the desktop. With this problem all the other idiotic choices that have been made for GNOME 3 it seems that RedHat only wants people to use Linux on servers and tablets!

I tried to compare the CPU utilization of a 1080p YouTube video with the hardware acceleration on and off, but when I had hardware acceleration on the video playback went completely haywire!

At least there is a quick and easy way to get YouTube videos with a blue tint back to normal, but there should be no need to fix such a simple problem in the first place. Clearly there was not enough testing before this update was pushed out!